How airlines set pricing is something that hasn't fundamentally changed in decades. It follows a model known as a "pricing ladder" where the total number of seats are divided up into booking classes, with each booking class representing a rung on the ladder. The lowest rung on the ladder will have the cheapest prices, and the highest rung will have the highest price.

Each booking class has its own fixed price point, and as the seats in each booking class are sold, the price goes up as the customer will need to buy a ticket from the next booking class (the next rung on the ladder) at a higher fare price. A typical flight can easily contain 15 or 20 different booking classes, each with its own unique letter of the alphabet to differentiate it.

Due to the complexities of this system and how airline tickets are sold through GDS (Global Distribution Systems) platforms, the only way an airline can really change pricing for an event such as a concert or school holidays is to remove availability of lower value booking classes, or if they've got excess seats they can add extra availability of lower booking classes.

As an Air New Zealand shareholder I like to pay particular attention to Air New Zealand's Investor Day which is held every year around May or June. This year it was held in late May, and of particular interest was Chief Revenue Officer Cam Wallace who discussed many aspects of the business and strategies that Air New Zealand were adopting to compete in an incredibly competitive environment dealing with increased costs and volatile oil prices. One aspect of the presentation that caught my eye was the mention of dynamic pricing.

(The following is a transcript from the Air New Zealand investor presentation that contains a couple of transcription fixes)

And this is my last slide, and it's one I get quite excited about, actually. Now this is our revenue management. So revenue management is the engine that supports the airline. It's the way we price the 500 flights we have every single day.

And revenue management has been facilitated historically through algorithms and software, global programs which look at historic demand patterns and then forecast forward what we believe the market will do. Now in the future, this is ripe for a disruption, and we've been working with a company called Fusion RM based in the states. And they will take all that historic data, but they will also look at polling data from the GDSs which travel agencies use, our websites and all other websites to actually give us a much greater understanding of future demand. So there's some really, really exciting pieces of work which are going to drive our thinking in terms of revenue management and how we can extract better returns using the capital and the assets that we have.

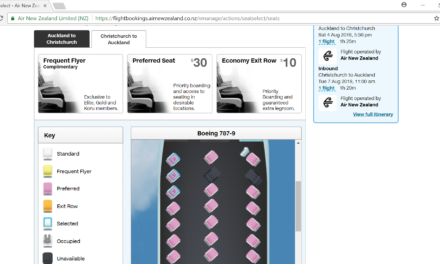

And this will mean real dynamic pricing. So instead of our fares being layered and laddered using letters in the alphabet, we will have a different price point for every different customer, for our Airpoints members for our golds, for our gold elites. So that's a tremendous opportunity for us and something that we will start a proof of concept on a couple of city pairs by the end of this calendar year.

Dynamic pricing is the concept of varying prices of a product or service for different customers. Retailers who engage in dynamic pricing may charge customers different prices for the same product or service - simply because the retailer knows that one customer is willing to pay more than the other for that product or service. Others who engage in dynamic pricing may simply use it to alter the price of a product or service based on demand, with Uber's surge pricing being something many will be familiar with.

In the online world dynamic pricing is used by some online retailers and accommodation booking sites who may rely on previous purchasing habits or searches to dynamically set a higher price for a product or service than that shown to another customer looking at the very same product. If you keep coming back to a website to purchase the same product you may simply accept a price increase without questioning it, probably without realising other customers may still be paying a cheaper price. Some accommodation providers who use dynamic pricing often use cookies stored on your web browser from previous searches or web beacons to dynamically change the price that it shows you for a room.

Searched multiple times for a hotel room in Las Vegas on a certain date? They know you want to stay in Las Vegas on those dates so can increase the price they will charge you which many people will happily pay once they've set their mind on a property. Many will just assume the property is filling up and so the price has gone up, rather than understanding dynamic pricing has offered you a higher price because it knew you were likely to take it. This can be demonstrated on some booking sites by searching for the same dates in a different web browser, deleting your cookies, or browsing in incognito which will show the very same room is still available at a cheaper price.

As an end consumer dynamic pricing is evil - it's not implemented to offer you a better deal, it's being implemented to drive profit margins. For a retailer or service provider it's the best value add proposition since sliced bread itself.

Being able to sell the same product or service at different price points to different customers and get away with this simply because some customers are not as price sensitive as others is pure genius.

All of this leads back to Air New Zealand's announcement that they're looking at dynamic pricing. Based on the comments by Wallace it would seem Air New Zealand are keen to differentiate pricing based on status level within the airline, and presumably those Elite frequent flyers who already typically spend a minimum of around NZ$15,000 per year with the airline to maintain their status will be a prime target.

By spending that much per year they already know you are very likely to have a lower level of price sensitivity compared to somebody who only books a single return flight per year. Elite customers are the perfect target to try and charge a premium to - simply because they believe they just can. They believe you're locked into the airline ecosystem with the Airpoints program and status and are unlikely to look elsewhere.

Flying with Air New Zealand already means paying what I refer to as the "Air New Zealand tax". On many occasions Air New Zealand is not the cheapest option to book flights on, and in many cases such as booking a Business Premier flight from New Zealand to London, the price can often be thousands of dollars more than other airlines, many of whom even arguably offer a better in-flight product. This however doesn't stop people from booking on Air New Zealand and paying a premium for this - it has however seen some high value customers abandon Air New Zealand for long haul travel due to these premiums.

It has also seen many abandon Air New Zealand once they have hit their Elite status. Once you've flown enough for the year to obtain Elite, flying on other airlines for the rest of the year allows you to obtain status with multiple airlines rather than keeping all your eggs in one basket.

While individuals on a plane now pay a myriad of different prices for their seat, this typically follows a rule that the people who booked their seat the earliest will have paid the least, and those who booked at the last minute will have paid the most. Changing this so customers pay a price based on their perceived level of price sensitivity changes the game entirely, and if Air New Zealand think the outrage at a safety video or scrapping newspapers from their Koru lounges is bad, just wait till customers discover that they're being charged a ticket price based not on when they purchased their ticket, but solely on how much the airline thinks they're willing to pay for a ticket based on their Airpoints status.

That's just a big can of worms waiting to be opened..